Over the last six years, we studied the connection between business results (growth, operating margin, inventory turns and Return on Invested Capital (ROIC)) and the link to company characteristics. What did we find? We consistently see that companies focused on functional excellence–a focus within a functional silo like manufacturing, transportation or distribution– or singular metrics– like inventory or costs– underperform against their peer groups.

To take action focus on these ten processes:

- Balanced Scorecard. Reward teams for cross-functional metrics. We like the metrics of growth, on-time and in-full orders, operating margin, inventory turns, and Return on Invested Capital (ROIC). Select 7-9 and hold all functions equally accountable. Focus functional metrics to improving reliability. For more on this topic, read the book Supply Chain Metrics That Matter.

- Customer-Centric Supply Chain. Understand what your customers value and deliver. Do this through assessment, top-to-top meetings, and ongoing feedback. Tie policy to action. Don’t make the mistake of only valuing net-promoter scores. (for more on this topic, check out the report on Customer-Centric Supply Chains.)

- Cost-to-Serve Analysis. In the supply chain, many organize the response by function. What seems like a low-cost option in one function is not always the lowest total cost alternative. For more on cost-to-serve analysis check out our recent report on supply chain finance.

- Maturity in S&OP. Seems like everyone in supply chain has an opinion on S&OP. Many renaming it and white-washing the basics. The best S&OP processes balance the “S” and the “OP”. The focus is on the ampersand. Aligned across the organization, the process focus is on executing the supply chain strategy. For more on S&OP and building a resilient process check out our report, Why is S&OP So Hard?

- Maturity in Analytics. The advancements in analytics–open-source, cloud, internet-of-things (IOT), and cognitive computing–are very promising. It requires the building of an analytics framework. For more information on advanced analytics, check out this report.

- Network Design Analysis. Supply chain excellence starts with design. Buffer strategies. Push/pull decoupling points. The design of transportation and supplier networks. It is about conscious choice in aligning assets and building cross-functional processes. In our data when the network design tools are used within a function, and only for that function, there is a negative correlation to value. When it is used holistically across make, source and deliver to design a network, there is a positive correlation to price to tangible book. Successful network design strategies are holistic crossing the boundaries of source, make and deliver.

- Supply Chain Center of Excellence. Thirty percent of supply chain leaders have a Supply Chain Center of Excellence but only 50% are successful. However, when the center of excellence is driving thought leadership against a strategy there is a statistically significant relationship to agility and alignment.

- Supplier Development. The management of supplier relationships is dependent on successful supplier development processes. Companies that outsource procurement and focus on transactional supplier management are less agile and struggle to be adaptable.

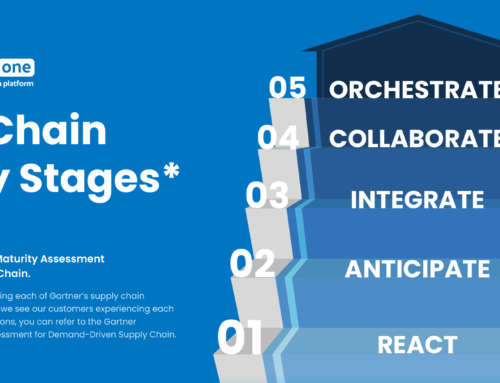

- Supply Chain Planning. The most advanced companies are good at supply chain planning. They use the technologies, have less dependency on excel spreadsheets and understand the need for “what-if analysis.” The focus is on the important not the urgent. For more insights, here is a recent report.

- Supply Chain Visibility. Supply chain visibility means different things to different people, but in our research it is the ability to understand the state of transactions between first and second tier trading partners and the sharing of planning data. For more reading check out our report.

Source: http://www.supplychainshaman.com/supply-chain-2/supply-chain-excellence/building-a-triple-a-supply-chain-ten-tactics-that-work/